Proactive Security: Bagley Risk Management Tips

Recognizing Animals Risk Security (LRP) Insurance Policy: A Comprehensive Overview

Navigating the world of animals risk security (LRP) insurance coverage can be a complicated venture for several in the farming industry. This sort of insurance coverage provides a safeguard against market changes and unexpected scenarios that could influence livestock manufacturers. By recognizing the complexities of LRP insurance coverage, manufacturers can make enlightened decisions that may guard their operations from financial dangers. From exactly how LRP insurance functions to the various protection alternatives readily available, there is much to uncover in this thorough guide that can potentially form the method livestock manufacturers approach threat administration in their businesses.

Just How LRP Insurance Coverage Functions

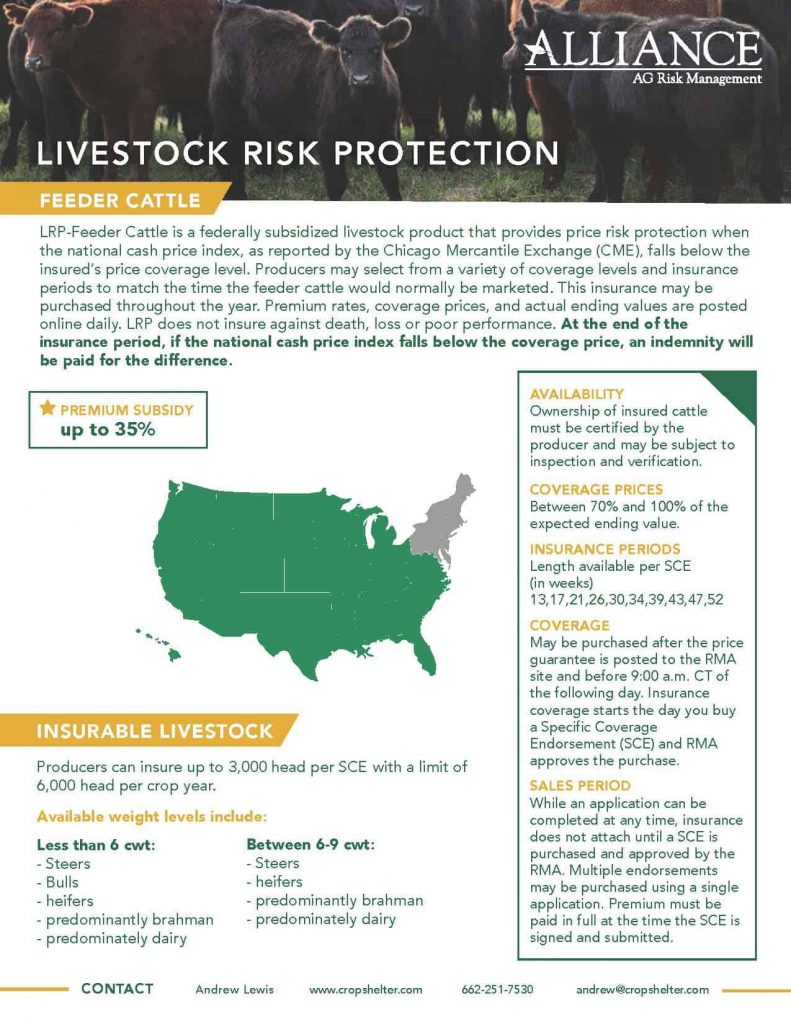

Periodically, recognizing the auto mechanics of Animals Risk Security (LRP) insurance coverage can be complicated, however damaging down how it functions can give clearness for breeders and farmers. LRP insurance coverage is a danger monitoring device designed to secure livestock producers versus unforeseen price decreases. It's essential to note that LRP insurance is not an earnings assurance; rather, it concentrates only on rate threat defense.

Qualification and Insurance Coverage Options

When it comes to protection options, LRP insurance coverage supplies producers the adaptability to pick the insurance coverage degree, insurance coverage period, and endorsements that finest fit their threat monitoring requirements. By recognizing the qualification requirements and protection choices available, animals producers can make educated choices to take care of risk efficiently.

Advantages And Disadvantages of LRP Insurance Policy

When examining Animals Threat Security (LRP) insurance, it is necessary for livestock manufacturers to consider the benefits and downsides integral in this danger administration device.

One of the main advantages of LRP insurance policy is its capability to supply defense versus a decline in animals prices. Additionally, LRP insurance provides a level of flexibility, permitting producers to tailor protection degrees and policy durations to match their certain demands.

One restriction of LRP insurance is that it does not secure against all kinds of dangers, such as disease episodes or natural disasters. It is important for manufacturers to meticulously analyze their private risk direct exposure and monetary situation to establish if LRP insurance policy is the best threat management tool for their operation.

Understanding LRP Insurance Premiums

Tips for Making Best Use Of LRP Benefits

Taking full advantage of the benefits of Livestock Threat Security (LRP) insurance requires strategic preparation and aggressive threat administration - Bagley Risk Management. To maximize your LRP coverage, think about the complying with pointers:

Consistently go right here Assess Market Problems: Stay educated about market fads and cost variations in the livestock sector. By keeping track of these aspects, you can make informed decisions concerning when to buy LRP insurance coverage to secure versus possible losses.

Set Realistic Coverage Levels: When picking coverage degrees, consider your production expenses, market price of animals, and prospective threats - Bagley Risk Management. Setting reasonable coverage degrees guarantees that you are appropriately secured without paying too much for unnecessary insurance

Diversify Your Insurance Coverage: As opposed to depending exclusively on LRP insurance, consider diversifying your risk administration techniques. Integrating LRP with other danger monitoring tools such as futures contracts or choices can offer comprehensive insurance coverage versus market uncertainties.

Testimonial and Change her response Insurance Coverage Regularly: As market conditions change, periodically examine your LRP protection to guarantee it lines up with your present risk exposure. Adjusting coverage levels and timing of acquisitions can assist enhance your danger protection technique. By following these suggestions, you can make best use of the advantages of LRP insurance policy and safeguard your livestock operation against unexpected risks.

Verdict

Finally, livestock danger defense (LRP) insurance coverage is an important device for farmers to manage the economic risks related to their livestock operations. By comprehending exactly how LRP functions, qualification and coverage alternatives, as well as the pros and cons of this insurance policy, farmers can make educated choices to secure their resources. By meticulously considering LRP costs and executing methods to optimize benefits, farmers can reduce potential losses and ensure the sustainability Check Out Your URL of their operations.

Animals manufacturers interested in obtaining Animals Risk Defense (LRP) insurance can explore a range of qualification criteria and protection alternatives customized to their certain livestock operations.When it comes to insurance coverage options, LRP insurance coverage uses manufacturers the flexibility to select the protection level, coverage duration, and endorsements that finest fit their threat administration requirements.To grasp the complexities of Animals Risk Security (LRP) insurance policy completely, recognizing the variables affecting LRP insurance policy costs is important. LRP insurance costs are identified by different components, consisting of the protection degree picked, the anticipated rate of livestock at the end of the protection period, the kind of animals being insured, and the size of the protection duration.Review and Adjust Coverage On a regular basis: As market problems change, periodically assess your LRP coverage to guarantee it aligns with your existing threat direct exposure.